2023 Economic Retrospective and Outlook 2024

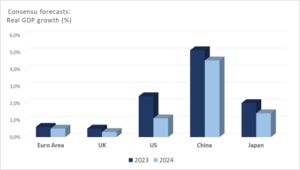

Global economic growth slowed down in 2023. The global growth will probably land around 2.9%[1] in 2023, compared to 3.5% in 2022.

Global economic growth slowed down in 2023. The global growth will probably land around 2.9%[1] in 2023, compared to 3.5% in 2022.

As a matter of fact, 2023 has been crossed by major economic events, some of which have had a significant impact on the global economy.

– The conflict between Russia and Ukraine, the war in the Middle East and the continuous deterioration of the global geopolitical context have brought severe strains to our globalized economic model.

– The lack of foresight regarding energy and food dependency coupled with the lack of local industrialization ambitions have led European governments to a ‘damage limitation’ policy.

Overseas, the US Administration has been trying to limit its dependance to the rest of the world since Covid pandemic; which sounded like a “wake-up call”.

– Inflation was another major theme of 2023. After reaching record levels, inflation has fallen in 2023. Even though we are on the road to disinflation, prices are still at high levels.

The fragmentation of commodities and food markets will remain an issue. The production or extraction of basic materials are indeed concentrated, making their prices particularly sensitive to the supply chain disruption due to the wars.

– The restrictive monetary policy contained inflationary pressures. Not only headline inflation but also wages are on the decline. Encouraging signs for Central Banks. Nevertheless, despite rates increase, restrictive monetary policies are less effective in the context of inflationary supply shocks. The race against inflation is not yet won. Central Banks have paused their rates rise but situation remains uncertain as inflation could peak from month to month.

– Last but not least, COP28 acted an historic agreement on the phasing out of fossil fuels and the European Union agreed on a legislative framework for artificial intelligence.

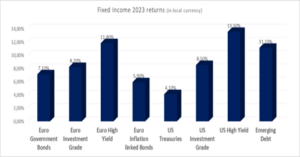

Financial markets performance in 2023[2]

2024: What could we expect?

- 2024 will be a year of elections. Some 40 countries will elect their president, while parliamentary elections will be held in twenty others. Roughly 4.1 billion people, or 41% of the world’s population, will be involved in elections in 2024.

If some votes seem to be obvious (Russia, Iran) the choice of Americans, Europeans or Indians voters could change the face of the world.

Belgians will also make their voices heard in 2024. The risk of seeing them voting massively for the extremes could make the setting up of a federal government complicated.

- The Central Banks speech will continue making headlines in the press.

- Recession? Soft landing?

Given geopolitical tensions, the level of inflation, the restrictive monetary policy and the public deficits, the leading indicators point a downturn in economic activity compared to last 2023.

We can also add the real estate crisis in China and the volatile commodity prices.

- Climate change and energy transition will also continue to dominate the news: between economic realities and ideological debate, authorities need to find pragmatic and sustainable solutions.

- Finally, investment in artificial intelligence and patenting in this field should continue to grow. Nearly USD 200 billion should be invested in AI by 2024.

Conclusion

It’s a safe bet to say that the geopolitical context will remain a predominant topic in 2024.

On the financial markets side, the cycle of interest rates hikes is at an end. The first signs of easing are not expected before the second half of the year.

The advanced indicators are showing a weakening of the activity in 2024. A soft landing of the economy is waited for United States. Europe is showing a more contrasted view.

Knowing that interest rates have reached their peak, a movement of cash to investments (more particularly in Bonds) is expected. Valuations and duration could bring investment continue to bring opportunities in Bonds in 2024.

Geographical asset allocation, good valuations and an attention to currencies will be key to build a good risk/return equity portfolio.

The surprise could come from Japan. The normalization of the monetary policy in Japan could lead to a massive repatriation of money back. A country to monitor closely.

Other trending Investment themes to follow in 2024 are the passive investments, the listed infrastructure, the artificial intelligence and the clean energy.

For more information. Please do not hesitate to contact Nicolas Fortomaris, Senior Manager Investments, via e-mail nicolas.fortomaris@DynaFin.be

[1] Source : Bloomberg consensus_ December 2023

[2] Source : Bloomberg