Financial Services Business Model Transformation

Financial Services Business Model Transformation

Financial Services Business Model Transformation

At DynaFin, we recognize that innovation is a driving force behind success in the financial services industry. In the dynamic landscape of the financial sector, the quest for sustainable growth and a competitive edge remains paramount. The importance of business transformation through innovation can not be understated.

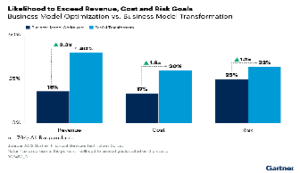

A recent study conducted by Gartner has shown that even small changes in the business model can lead to substantial & incremental improvements in revenue, cost, and risk goals.

TRANSFORMERS vs. OPTIMIZERS

Although sometimes used interchangeably, business model transformation and business model optimization differ in scope, goal, level of change, timeframe & approach.

A “Business model transformation” involves a holistic approach and a comprehensive overhaul of the existing business model. Business model optimization however, focuses on targeted improvements to existing processes and strategies within the current business model framework, without making significant changes to its core components.

The aimed outcome varies because a transformation aims to change the process to achieve improvements in revenue generation, cost efficiency, and risk management. Meanwhile, Optimizers aim for incremental improvements in performance metrics such as revenue, cost reduction, and risk mitigation, aiming to enhance efficiency within the existing operational structure.

To achieve a transformation, the company must entail radical changes, potentially disrupting traditional business practices and requiring significant organizational adaptation. Business model optimization involves fine-tuning existing processes, leveraging incremental changes to enhance operational efficiency and effectiveness while minimizing disruption. Naturally, Business model transformation carries higher inherent risks and rewards compared to business model optimizers.

Between transformers and optimizer, partial transformers are those that have done more than purely optimize but, have yet to fully transform their business.

The recommendations for financial leaders that want to transform their business models is that they should start making small changes to 4 key characteristics in their business:

o the value proposition,

o customer base,

o the financial model &

o the business/technological capabilities.

It’s important to create an individual transformation roadmap that account for the current business circumstances. Focusing on a few transformative initiatives that make the most sense for a firm’s unique situation is a more sustainable path to true transformation than (trying to) spread the budget thin across all characteristics. The table below gives characteristics of optimizers and transformers on the 4 different business model components:

The management is in the driver’s seat.

In the study by Gartner on business transformation, financial leaders are warned to keep the operating model and business model aligned to maintain performance, since these two are intertwined.

o A business model and strategy set a vision for value creation;

o The operating model reflects how firms turn this vision into a reality.

Changing the business model implies changes in the operating model, in order to prevent stalling performance. Companies will find it increasingly difficult to maintain operating alignment, as they add more changes to the business model. At the later stages of transformation, leaders will only be able to change their business models as quickly as their operating models can keep pace.

Indecision, misalignment and discord among senior leaders and the C-Suite is one of the most common and significant barriers to any successful transformation effort. It’s good practice to document the current state of the business model and the current operating model to establish a common understanding. This can be done by a business- or process analyst.

Most commonly the leadership need two deliverables:

1. A customized enterprise operating model (EOM) that uses commonly understood language that can be understood across the enterprise.

Technical leaders should avoid jargon in order to communicate clearly so that business leaders understand the process in dept. Business leaders should document the outcomes they want to achieve. Enterprise operating performance (for example with the use of BPMN), might identify blocking points.

2. Business capability models that deconstruct and operationalize the business strategy.

Current-state business capabilities, which should be a living document as capabilities evolve.

Future-state business capabilities, which the governance structure will likely need to determine and adjust through ongoing changes.

These documents can be used to monitor how processes and resources operate within the business. Leaders can strategize about how changes to one component might influence the others and plan for contingencies. The goal is to reduce the number and severity of surprises and performance disruptions. To follow up on these goals it is important that financial leaders conduct regular check-ins during cross-functional governance meetings

STUDY RESULTS

Ultimately, when the firm moves from optimizers to transformers, they should experience improvements in 3 fields:

o Revenues

o Costs

o Risks

The figure below shows the improvements in the areas mentioned above while making a comparison between business optimizers & business transformers:

The greatest improvements in performance occur in the early and late stages of business model transformation. This means that, if performance stalls, it will most likely occur in the middle of transformation right before the true business model transforms.

The results of one study found that firms that fully transform their business models have up to 3.3x higher chance of exceeding revenue, cost goals and risk goals compared to those who’ve only focused on business model optimization.

Partial transformers have up to 2.3x higher chance of exceeding than those only focused on business model optimization.

Conclusion

Business model transformation has the potential to significantly improve Financial Institutions performance and gives a competitive edge, but it can be a long and (potentially) difficult journey. Starting early and maintaining consistent, modest changes can yield incremental improvements in the short term and sustainable performance leaps in the long term.

To maintain performance improvements, financial services leaders should focus on improving how they work together to keep the operating model aligned to the modified business model.