The Private Banking industry is now familiar with VUCA acronym: Volatility Uncertainty Complexity Ambiguity. This is as a matter of fact the world we are living in.

Therefore, the Private Banking industry leaders are required to change their reading grid and set up an agile organization in order to face rapid changes on the market, to take decisions without having a crystal-clear view, to solve complex interdependent problems and deal with short term profitability need versus long term sustainability. This job is far from straightforward.

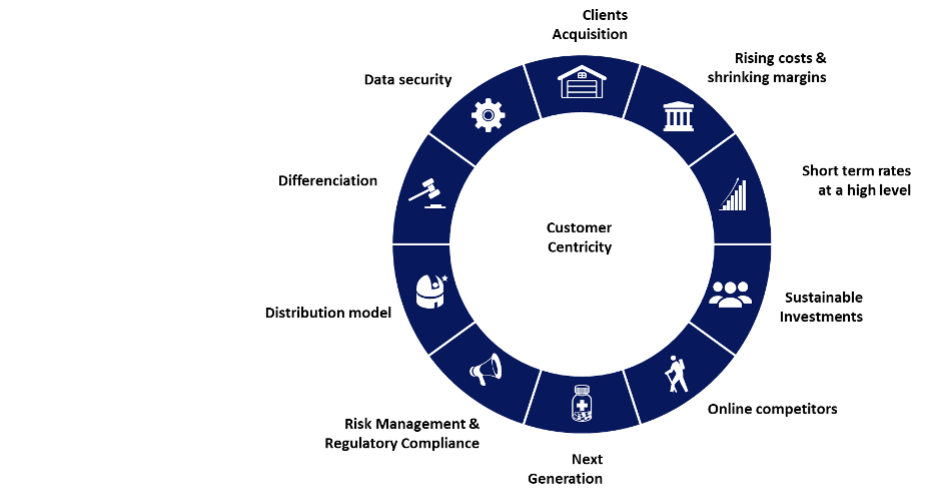

As the new VUCA context disrupts the status quo, banks Executives ought to tackle shifting stakeholders’ expectations by answering existential challenges against a backdrop of societal, technological, regulatory, risk and business landscape.

Private Banking Challenges

How can Private Banking Industry cope with the new trends?

The private banking industry, like many other financial sectors, is constantly evolving in response to new trends and challenges. To cope with these changes, private banks must continuously adapt their Business Model.

-

Review on a continous base your business model: from service design to communication passing by distribution channels:

- Coherence is the key word.

- Review each link of your value- chain based on a client centricity approach. This means a bottom-up approach from clients’ needs to company answers. Bear in mind that the best solution will not encounter the market if there is no market.

- In parallel, clients’ promises should be the backbone to shape your Corporate Social Responsibility (CSR policy).

- Go beyond wealth management services by creating an holistic approach to build a long-term partnership with your clients.

- Maintain a high level of transparency in fees, charges, and investment strategies (K.I.I.S).

-

Integrate E.S.G has an enabler to capture new market share

- Develop expertise in sustainable finance and impact investing. This is the way to go.

- Many thought E.S.G investments was a niche market for a specific client segment. They were therefore overtaken by events where they browsed Europe Commission regulatory E.S.G framework.

- Different investment approaches are possible. Once again make the link between clients needs and your offering.

-

Invest in technologies and human expertise to:

- Offer a tremendous client experience.

- Streamline operations.

- Use data as a product to understand and interact with your clients.

- Personalize services and tailor investment advice with the help of IA.

- Collaborate with fintech companies and other financial institutions to leverage on their technology and expertise.

- Secure client’s data.

-

Implement robust compliance and risk management processes:

- Start from regulatory requirements to shape the risk assessment plan.

- Schedule all major regulatory changes well in advance.

- Conduct regular audits & monitoring to test the suitability of processes.

- Stay close to your operating teams to understand the business and provide an efficient framework of controls.

-

Aim for an optimal operating model

- Reaching an optimal operating performance in any organization involves a combination of strategic planning, efficient processes, effective management and continuous improvement.

- Encourage a culture of continuous improvement across the organization.

- Use data analytics to gain insights into your operations and make informed decisions.

- Implement lean processes through all your organization.

- Use technology to automate regular tasks without added value.

- Explore near/offshoring possibilities.

Conclusions

- With a pressure on both cost and revenue baseline, Private Banking industry have once again to renew itself. The average cost to income ratio of European Private Banks rose from 77.7% to 82.4% between 2018 and 2023. On the other hand, return on asset has fallen from 80.6 bps to 71.6 bps on the same period[1].

- IT costs and regulatory costs have blown up. New clients’ expectations and commodization of investments services have decreased margins.

- Sustainable Finance will impact drastically business models and internal organization for decades.

- Invest in expertise, the VUCA environment requires a 360-degree approach,

- Adopt the agile risk management: from check list assessment mitigation to yearly market mitigation,

- See each challenge, new trend as an opportunity to generate business,

- Be focus on your clients’ expectations: grow or degrow your range of solutions consequently.

Despite, Private Banking industry shows a cautious optimism on new trends and feels unprepared to cope with radical changes, the industry has a remarkable track record in the context of changes. For us it is not as simple as adapt to the new context or fail. Depending on your organization incremental adjustments will be enough for others a global review of the business model will be needed. Bear in mind to build up consistent plan to deploy your model cross silo in your organization.

Written by Nicolas Fortomaris, Senior Manager Invest

More info on this topic, please mail to: Nicolas.fortomaris@dynafin.be or call +32 (0) 495 61 60 33

[1] Data sample including 20 major European Private Banks