Tackling the challenges of EMIR REFIT

Research in the Belgian banking sector

This new update to EMIR is in line with the long harmonization efforts by global regulators and ESMA to improve the quality of reported derivatives data. EMIR Refit brings a lot of new changes, like the reporting of new data fields and the new ISO XML reporting format. Those changes will require large efforts from all reporting counterparties, with firms often referring to it as a “new regulation”.

Maxime Balis, consultant at Dynafin Consulting, explores the most important changes and prominent obstacles Belgian banks face in implementing EMIR Refit and how they intend to tackle those challenges to ‘be ready’ by due date.

EMIR reporting explained

EMIR stands for European Market Infrastructure Regulation (EMIR) and lays down clearing and bilateral risk management requirements for OTC derivative contracts, reporting requirements for derivatives contracts and uniform requirements for the performance of activities of central clearing counterparties (CCPs) and trade repositories (TRs). It has been firstly introduced in 2012, as a response to the financial crisis. The goal of EMIR is to reduce systemic counterparty and operational risks and thereby prevent future financial system collapses by increasing the transparency & supervisory framework.

All the rules and guidance on reporting, registering, and accessing data for implementing EMIR provisions are developed by the European Securities and Markets Authority (ESMA). Depending on certain thresholds and requirements, companies entering into derivatives contracts are required to report under EMIR, including Financial Counterparties (FC) and Non-Financial Counterparties (NFC). Moreover, the National Bank of Belgium (NBB) and the FSMA monitor compliance of the EMIR requirements towards FCs and NFCs, respectively.

The main changes of EMIR REFIT

On 7 October 2022, the ESMA published the final guidance of EMIR Refit in the Official Journal of the European Union (EU), with the go-live date for EU Members on 29 April 2024.

The key changes of EMIR Refit are:

- New ISO 20022 XML reporting format: currently under the existing EMIR, reporting firms must report in CSV format to a Trade Repository. But as of 29 April 2024, CSV formats will no longer be supported. ESMA will introduce the harmonized XML submissions for EMIR reporting as part of global standardization.

- New reporting fields: In the new EMIR Refit, there are 203 fields to be reported, which is 74 more fields than the old EMIR. There are 89 new fields, 15 fields that have been deleted and among the common 124 fields between EMIR and its refit, 81 existing fields were updated, either in format and/or content.

- Unique Product Identifier (UPI): Those identifiers will be assigned to an over the counter (OTC) derivative product and used for identifying the product in transaction reporting data.

- Generation process of the Unique Trade Identifier (UTI): New standards and rules will apply for generating the UTI, which will change the current arrangements between entities.

- Revised reporting logic: ESMA has revised its approach to the reporting of lifecycle events and introduced the Event Type field. This will not only allow authorities to fully understand the status of a trade (e.g., whether it is outstanding or not), but also the nature of the event that impacted it.

- Notification of any significant data quality issues to NCAs: to ensure that authorities have enough visibility on significant reporting problems, entities responsible for reporting should notify the competent authorities of relevant errors and omissions in their reporting.

The main challenges for financial institutions

The new changes of EMIR Refit will trigger the existing reporting processes of financial institutions which can require significant operational adjustments. They may need to update their internal processes, systems, and infrastructure to comply with new requirements, which can be resource intensive. There is no denying that these changes bring many new challenges.

The biggest challenges identified in the Belgian financial market are:

- Data sourcing: firms must figure out where to get the additional data points from. Data could be available internally, but a lot of other data will inevitably have to be obtained from third party data providers (e.g., collection of UPI).

- Data management and quality: collecting, validating, and reporting accurate and complete data to regulatory authorities to ensure the quality of a large volume of data is a major challenge as well for financial institutions.

- Reporting complexity: the introduction of the event field brings more complexity to the reporting logic of EMIR. This new logic adds a multitude of event scenarios for which institutions struggle to clearly define which combination scenario they are confronted with. The correct combination will trigger the fields to populate.

- New reporting format: it requires a significant amount of effort for institutions to update their reporting systems, along with their testing and control processes, to meet the required ISO 20022 standard. A great deal of knowledge and experience from IT teams is needed to be able to create this kind of file, which is not always available.

- Time constraint: time was certainly identified as the biggest challenge.

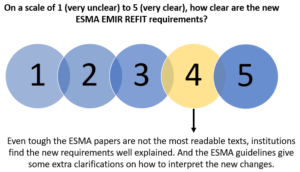

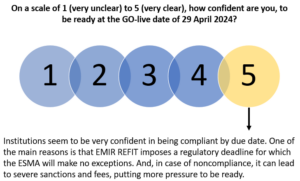

We asked Belgian financial institutions on two things:

How Belgian banks intend to tackle those challenges

One respondent explained they would tackle the overall challenges by prioritizing the most urgent tasks for the involved project teams and emphasizing the urgency. They advise discussing with Compliance & Legal to move priorities and shift enough resources to ensure the readiness of the project. Another solution is to work with different product phased deliveries to spare some time and be ready for production on 29 April 2024. But this solution is best used as a last resort, as it does not necessarily guarantee an optimal reporting solution, which can ultimately create other problems later.

Another respondent explained that they will only report the mandatory fields and leave optional fields blank. The reason for this is time constraint and a problem of data sourcing. This gives them more time and resources to focus on the mandatory fields and will ensure a minimum viable report on due date. Because even if you are not ready on production date, you are required to report, under the new rules of EMIR, to an authorized Trade Repository of your choice. Otherwise, your report, if submitted, will be rejected, and it will likely be escalated to your regulatory authority (e.g., NBB), which may cause the risk of fines.

Some participants took advantage of the changes implied by EMIR REFIT to outsource their reporting to an external firm. This allows them to start from scratch and rebuild a solid, compliant reporting. And, of course, it removes a heavy burden from the analyses and developments that need to be carried out following REFIT. Indeed, delegating your EMIR reporting to a third party can be a good solution to overcome those challenges and guarantee qualitative reporting. However, it is important to weigh up the pros and cons before deciding whether to keep reporting in-house or outsource it, because it can quickly cost you a lot of money.

Conclusion and advice

With all the challenges REFIT brings, it is now more than ever time to start working on a more robust solution that will fulfill both current and future needs. That is why we strongly advise you to engage with your Legal & Compliance experts who specialize in derivatives and regulatory frameworks. They can provide insights into the legal implications of EMIR REFIT and help ensure your organization’s compliance. Including operational teams in the early stages of the project like the testing phase is also something you could anticipate on.

This will ensure that they will be ready when going into production. We also recommend interacting and collaborating with your industry peers. It is a nice opportunity to participate in forums or working groups to share insights and best practices. For example, DTCC, an international Trade Repository, is organizing bi-weekly working group sessions on EMIR REFIT. Finally, if you decide to outsource your EMIR reporting, there are some very good reporting service providers available on the market who can offer you personalized reporting solutions for EMIR reporting like DeltaconX, IHS Markit & DTCC Report Hub, not to name a few.

An article by Maxime Balis – Consultant at DynaFin.